Present Value of an Annuity Explanation & How to Determine

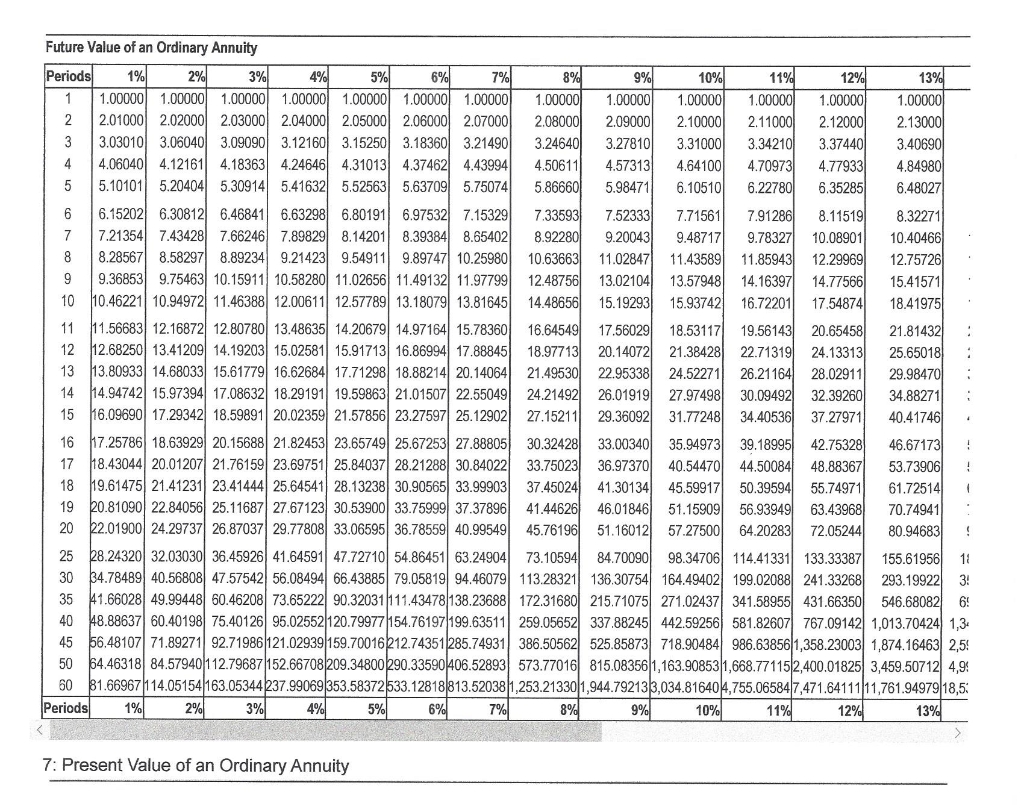

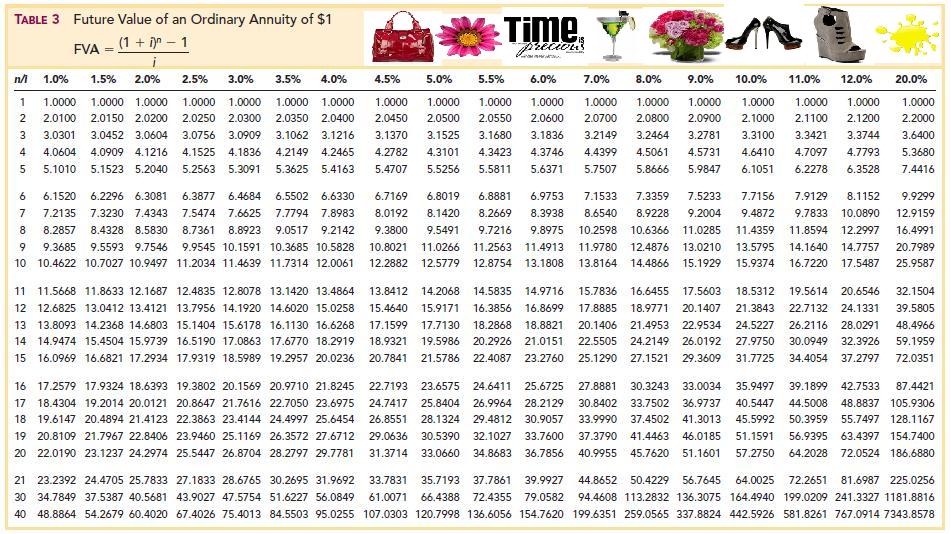

In the PVOA formula, the present value interest factor of an annuity is the part of the equation written as a formula for finding the present value of an annuity multiplied by the payment amount. If you consult an annuity table, you can easily find the PVIFA by identifying the intersection of the number of payments (n) on the vertical axis and the interest rate (r) on the horizontal axis. When t approaches infinity, t → ∞, the number of payments approach infinity and we have a perpetual annuity with an upper limit for the present value. You can demonstrate this with the calculator by increasing t until you are convinced a limit of PV is essentially reached. Then enter P for t to see the calculation result of the actual perpetuity formulas. If you’re interested in selling your annuity or structured settlement payments, a representative will provide you with a free, no-obligation quote.

Bankrate logo

The present value calculation considers the annuity’s discount rate, affecting its current worth. The factor is determined by the interest rate (r in the formula) and the number of periods in which payments will be made (n in the formula). In an annuity table, the number of periods is commonly depicted down the left column. Simply select the correct interest rate and number of periods to find your factor in the intersecting cell. That factor is then multiplied by the dollar amount of the annuity payment to arrive at the present value of the ordinary annuity.

Annuity Tables and the Time Value of Money

Present value tells you how much money you would need now to produce a series of payments in the future, assuming a set interest rate. Find out how an annuity can offer you guaranteed monthly income throughout your retirement. Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy. We are compensated when we produce legitimate inquiries, and that compensation helps make Annuity.org an even stronger resource for our audience.

Which of these is most important for your financial advisor to have?

In reality, interest accumulation might differ slightly depending on how often interest is compounded. This slight difference in timing impacts the future value because earlier payments have more time to earn interest. Imagine investing $1,000 on Oct. 1 instead of Oct. 31 — it gains an extra month of interest growth. You can purchase an annuity by making a single payment or a series of payments. An annuity table, which involves plenty of arithmetic, tells you the present value of an annuity. Understanding annuity tables can be a useful tool when building your retirement plan.

Invest Like Todd

There are many reasons you might want to know the present value of your annuity. Chief among them is the ability to tailor your financial plan to your current financial status. The present value of your annuity is a component of your net worth, and you need this information to ensure a comprehensive picture of your finances. Annuity.org is a licensed how to file a tax extension insurance agency in multiple states, and we have two licensed insurance agents on our staff. However, we do not sell annuities or any insurance products, nor do we receive compensation for promoting specific products. Discover the scientific investment process Todd developed during his hedge fund days that he still uses to manage his own money today.

- Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

- The savings annuity will have a balance of [latex]\$221,693.59[/latex] after the [latex]20[/latex] years.

- The present value of annuity table contains the factors used to determine an individual cash flow at one point in time.

- By calculating the present value of an annuity, individuals can determine whether it is more beneficial for them to receive a lump sum payment or to receive an annuity spread out over a number of years.

- For example, suppose that a bank lends you $60,000 today, which is to be repaid in equal monthly installments over 30 years.

The present value (PV) of an annuity is the discounted value of the bond’s future payments, adjusted by an appropriate discount rate, which is necessary because of the time value of money (TVM) concept. Although you could use this technique to solve all future value of an annuity situations, the computations become increasingly cumbersome as the number of payments increases. In the above example, what if the person made quarterly contributions of [latex]\$250[/latex] for three years? That is [latex]12[/latex] payments over three years, resulting in [latex]11[/latex] separate future value calculations. Or if they made monthly payments, the [latex]36[/latex] payments over three years would result in [latex]35[/latex] separate future value calculations!

Present value calculations can be complicated to model in spreadsheets because they involve the compounding of interest, which means the interest on your money earns interest. Fortunately, our present value annuity calculator solves these problems for you by converting all the math headaches into point and click simplicity. The Present Value of Annuity Calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods.

People yet to retire or those that don’t need the money immediately may consider a deferred annuity. Present value (PV) is an important calculation that relies on the concept of the time value of money, whereby a dollar today is relatively more “valuable” in terms of its purchasing power than a dollar in the future. You might want to calculate the present value of the annuity, to see how much it is worth today. This is done by using an interest rate to discount the amount of the annuity.

Behind every table, calculator, and piece of software, are the mathematical formulas needed to compute present value amounts, interest rates, number of periods, payment amounts, and other future value amounts. In present value calculations, future cash amounts are discounted back to the present time. (“Discounting” means removing the interest that is imbedded in the future cash amounts.) As a result, present value calculations are often referred to as a discounted cash flow technique. It’s important for you to understand that present value calculations involve cash amounts—not accrual accounting amounts. Annuity tables estimate the present value of an ordinary fixed annuity based on the time value of money. Consider that every dollar has earning potential because you can invest it with the expectation of a return.

These calculators use a time value of money formula to measure the current worth of a stream of equal payments at the end of future periods. The future value of any annuity equals the sum of the future values for all of the annuity payments when they are moved to the end of the last payment interval. For example, assume you will make [latex]\$1,000[/latex] contributions at the end of every year for the next three years to an investment earning [latex]10\%[/latex] compounded annually. The present value of annuity table contains the factors used to determine an individual cash flow at one point in time. This can be done by discounting each cash flow back at a given rate by using various financial tools, including tables and calculators.