The Quality of Financial Statements: Perspectives from the Recent Stock Market Bubble by Stephen H Penman :: SSRN

The company could nonethelesshave high reporting quality if it calculated its results properly and provided decision-usefulinformation. Although it is theoretically possible that a company could have low-qualityearnings while simultaneously having high reporting quality, experiencing poor financialperformance can motivate the company’s management to misreport. High-quality earnings reflect an adequate level of return on investment and are derivedfrom activities that a company will likely be able to sustain in the future. While the primary financial statements are essential, health care leaders should also be familiar with financial ratios and benchmarks derived from these statements.

Quality of Financial Reports and Earnings

We have also seen a general reduction in the number and severity of restatements of financial statements since the implementation of the Sarbanes-Oxley Act, although there are some specific areas that could benefit from a redoubling of efforts. The positive signs are attributable, at least in part, to improvements in audit quality and the enhanced role that auditors generally now discharge in providing an essential check in the financial reporting process. Preparers, of course, are not solely responsible for maintaining the strength of financial reporting.

Understandability:

- Financial statements are based on historical data and often use estimates and projections.

- That is certainly my view, and I want to commend Chairman Doty and the PCAOB board and staff for the important work they have done—and continue to do—in raising the bar for auditors and audit quality.

- Cash flow management is particularly important in health care, where billing cycles can be lengthy and unpredictable.

- Major users of such information include investors, creditors, employees, customers, commercial creditors and government.

We need to be frank about any challenges in the operation and assessments of ICFR and address them to the extent appropriate. But at the end of the day, ICFR must remain the strong bulwark of reliable financial reporting that it has become. Key to our mutual success is maintaining high-quality reporting of reliable and relevant financial information that investors can use to make informed investment decisions. If there is even one weak link in the financial reporting chain, investors and the integrity of our markets suffer. We must all work together in order to fulfill the high expectations investors rightly set for financial reporting.

Timeliness:

It is a pleasure to be here to speak to you about our shared and weighty responsibility to maintain high-quality, reliable financial reporting. This audience—preparers, auditors, audit committee members, and their advisors—is a very important one for the SEC. Investors, issuers, and the markets all depend on the work you do and the judgments you make—and how well you do both. You, together with the standard setters and the regulators, have a vital stake in ensuring that our capital markets remain the safest and strongest in the world—and we all share the responsibility. Prudent investors should only consider investing in companies with audited financial statements, which are a requirement for all publicly-traded companies. Perhaps even before digging into a company’s financials, an investor should look at the company’s annual report and the 10-K.

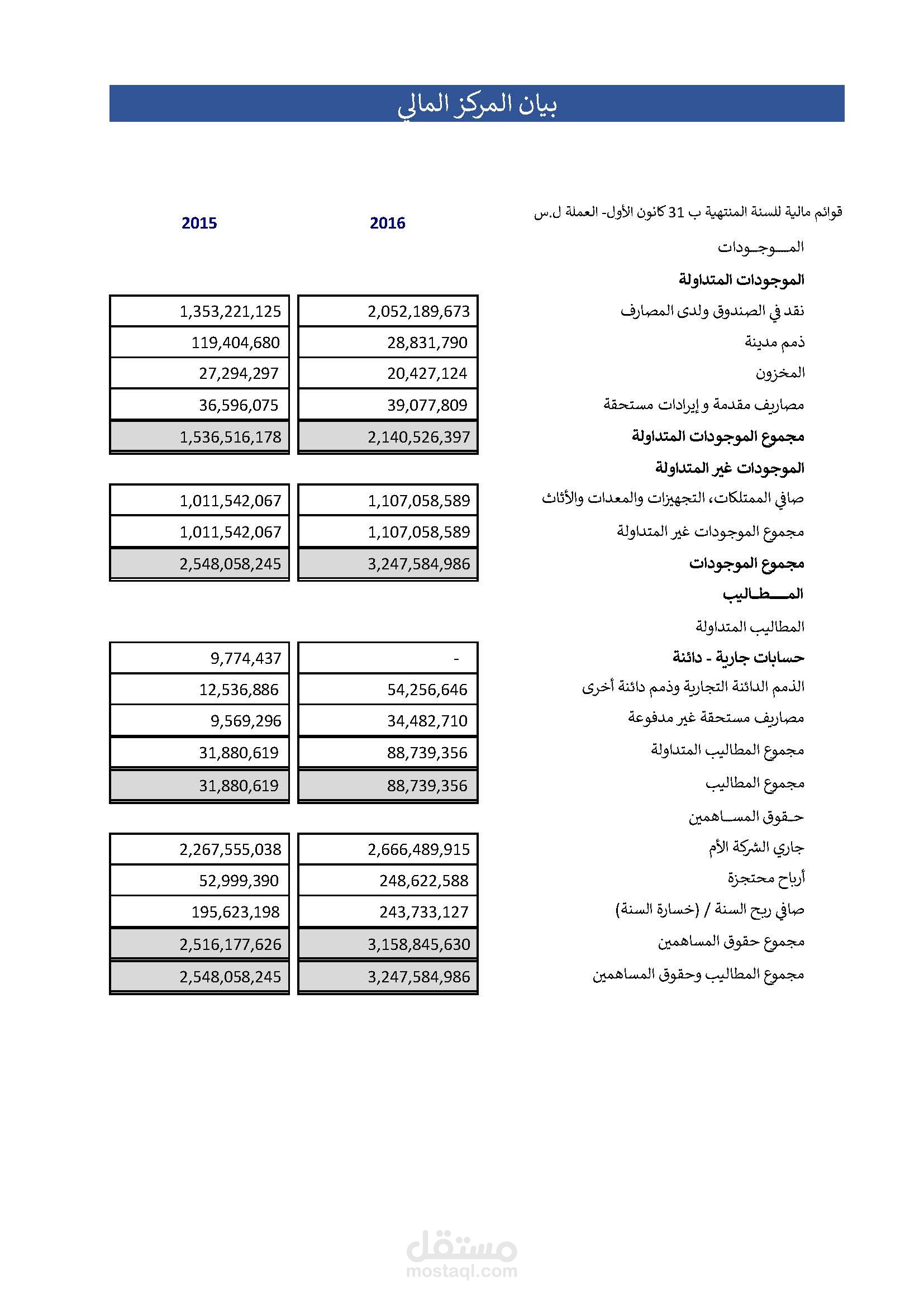

As noted by auditors on financial statements “the accompanying notes are an integral part of these financial statements.” Please include a thorough review of the noted comments in your investment analysis. Qualitative factorscontributing to Chanos’s view included the company’s aggressive revenue recognitionpolicy, its complex and difficult-to-understand disclosures on related-party transactions,and one-time earnings-boosting gains. Later events that substantiated Chanos’s perspectiveincluded sales of the company’s stock by insiders and the resignation of senior executives. The balance sheet provides a snapshot of an organization’s financial position at a specific point in time.

Program on Corporate Governance Advisory Board

Innate factors of the quality financial reporting consist of an operation cycle, sales volatility, firms’ size and firms’ age. In this case, a firms’ operation cycle is the most important variable to operate a company. Hence, it needs a firm’s operation cycle, which can be understood by all employees (Arachchi et al., 2017). High sales volatility shows that sales information has the wrong estimation, which can cause un-persistent results (Nezami et al., 2018; Prasetyo et al., 2023). The unstable sales proxied by high sales volatility will make lower firms’ valuation and vice versa.

Leaders should be vigilant about cash flow trends to avoid potential shortfalls that could jeopardize patient care and operational sustainability. This statement is vital for understanding profitability and operational efficiency. Health care is an unusual business model as the pricing for services is negotiated with insurance companies or dictated by governmental entities.

Actions have been taken to lower stock levels, improve the range, reduce operating costs and strengthen leadership and we expect the business to stabilise in the next year. The ambition for International is to build a global omni-channel business, which brings the magic of M&S to customers around the world. The recent improvement in performance of the UK business, and the strength of the M&S brand and its partners provides a significant opportunity for growth, although results in the period were disappointing. Our online business made progress in the period, with double digit growth in Clothing & Home, and the exit of the bulky furniture category.

For example, before you start crunching numbers, it’s critical to develop an understanding of what the company does, its products and/or services, and the industry in which it operates. Collectively, these sections reconcile the income statement and the balance sheet, showing the overall cash position of the company. Furthermore, the income statement mentions the gains and losses from non-recurring events, such as the sale of an asset or lawsuit settlement. It subtracts total expenses and losses from total revenues and gains to derive the net income, which indicates the company’s profit for that period.

Hence, a knowledge-based economy plays a significant role in enhancing the performance of business firms and improving FRQ. In this study, using various knowledge-based economy criteria, we attempted to assess the relationship between the knowledge-based economy and the chance of fraudulent reports in listed firms on the Tehran Stock Exchange. The obtained results in this paper confirm that of concerning a negative relationship between financial statements fraud (Koolivand et al., 2021). The purpose of financial reporting is to provide financial statement users with financial information that is useful for making economic decisions (Kaawaase et al., 2021).

Generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) are used to prepare financial statements. The main difference between the two methods is that GAAP is more “rules-based,” while IFRS is more “principles-based.” Both have different ways of reporting asset values, depreciation, and inventory, to name a few. The lack of any appreciable standardization of financial reporting terminology complicates the understanding of many financial how to file your federal taxes statement account entries. There’s little hope that things will change on this issue in the foreseeable future, but a good financial dictionary can help considerably. However, the diversity of financial reporting requires that we first become familiar with certain financial statement characteristics before focusing on individual corporate financials. In this article, we’ll show you what the financial statements have to offer and how to use them to your advantage.