Valuation of financial reporting quality: is it an issue in the firms valuation?

A strong balance sheet and consistent cash flow indicate a company is financially stable and can manage its debt obligations. According to (IASB, 2018), the information quality revealed in the firm’s financial report can help users evaluate the benefit of the financial report. Therefore, financial reports must be presented accurately, comparably, be verifiable, on time and understandable. It is important that the financial report must be on time and predictable as an indicator to produce high-quality financial report (Mbawuni, 2019). The scope of financial reporting is broader than just reporting information through income statements, balance sheets, authoritative pronouncements, and regulatory rules. In the encouraging column, investor confidence in audited financial statements and independent auditors is high.

Services

Adjusted results are consistent with how business performance is measured internally and presented to aid comparability. Results of Republic of Ireland (ROI) have been reclassified from the International segment to be reported within Food and Clothing & Home. Cash flow management is particularly important in health care, where billing cycles can be lengthy and unpredictable.

Quality of Financial Reports and Earnings

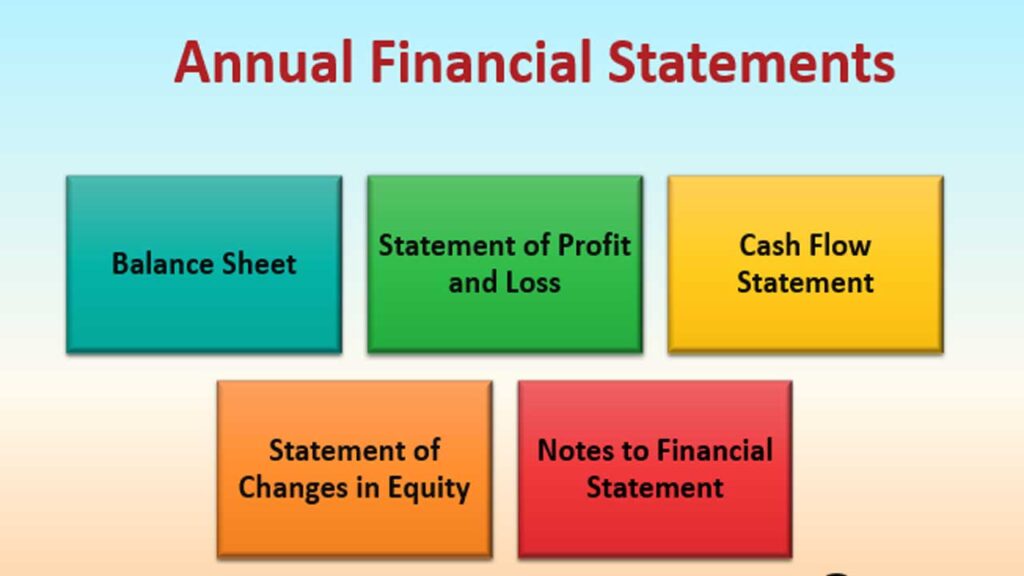

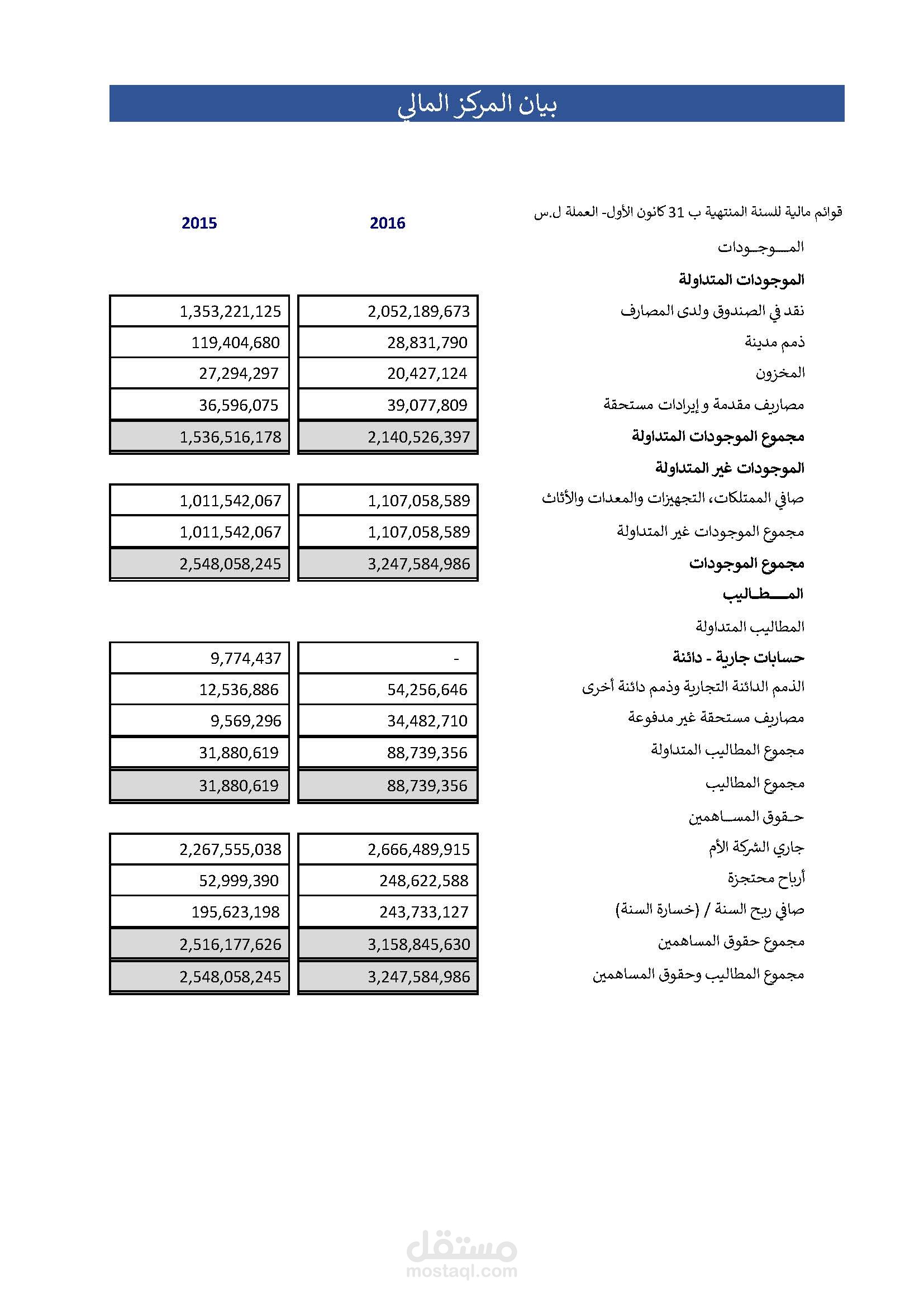

- The three components that help establish the financial conditions of a business are namely the income statement, balance sheet and cash flow statement.

- We need to be frank about any challenges in the operation and assessments of ICFR and address them to the extent appropriate.

- First, the quality of a financial report shows the company’s performance, which reflected on the profit information.

Investment will also be made in the data engine and the Sparks loyalty programme to deliver a more personalised customer experience. Non-GAAP measures and alternative profit measures (APMs) are discussed within this release. A glossary and reconciliation to statutory measures is provided at the end of this document.

Data availability

It remains a critical objective to grow online participation from the current 1/3 mix of Clothing & Home sales and we are addressing issues in fulfilment and website performance which provides opportunities for growth. As M&S continues to invest in the early stages of ‘Reshaping for Growth’, the business has what is accounts payable definition, job description and software delivered improved sales and volume, profit and market share in both Food and Clothing & Home. Financial statements are based on historical data and often use estimates and projections. Users should be aware of these inherent limitations when using these statements for making decisions about the future.

What are the main aims of financial reporting?

M&S’ People Director ran all aspects of a store for three months during the period, taking accountability to improve and resolve the issues found. We aim to promote at least 50% of leadership internally with the expectation that promoted colleagues spend at least one month working in customer-facing roles. In Clothing, deeper buying into campaign lines and on-trend collaborations have driven yet another move on in style perception, with Womenswear and Menswear attracting new customers. Our authoritative lead on quality and value has supported strong full price sales in a promotional market.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists has an advertising relationship with some of the companies included on this website.

They are essential to business planning, regulatory compliance and sound financial health. Financial statements serve as a control mechanism, to ensure companies comply with legal obligations. In most jurisdictions, financial reports must follow accounting standards like Ind AS. To investors, the scope of financial statements includes judging a company’s growth prospects, profitability and financial strength. These reports help them determine whether to purchase, retain or sell shares of the company in question. When a company applies for a loan or other credit facilities from banks or financial institutions, they examine the financial statements of that company before approving or rejecting the request.

It is a prime example of how the cooperation between the two boards can produce high-quality standards that now will be globally consistent. Other success stories include reporting for business combinations and fair value measurements. Information on the state of the economy, the industry, competitive considerations, market forces, technological change, the quality of management and the workforce are not directly reflected in a company’s financial statements. Investors need to recognize that financial statement insights are but one piece, albeit an important one, of the larger investment puzzle. The numbers in a company’s financial statements reflect the company’s business, products, services, and macro-fundamental events. These numbers and the financial ratios or indicators derived from them are easier to understand if you can visualize the underlying realities of the fundamentals driving the quantitative information.

If net income is higher than it was the previous quarter or year, and if it beats analyst estimates, it’s a win for the company. FRQ is measured by using accrual quality, which is revenue that is acknowledged at the time of a firm’s existence. Due to the hand-over of goods to external and some expenses or liabilities from the purchase of goods. This research is using a quantitative approach and testing a theory by formulating some hypotheses. The sample of this study is 85 go public companies listed in the Indonesia Stock Exchange, for a 5-year observation period from 2016 to 2020.

Early-stage modernisation of the supply chains includes the roll out of a new forecasting and ordering system in Food, warehouse capacity investments and the multi-year development of a new planning platform in Clothing & Home. While structural cost savings have largely offset the impact of operating cost inflation in the current year, further investment in efficiency initiatives and automation will be needed. Our vision is to be the UK’s most trusted retailer, with quality products at the heart of everything we do. We are making progress, with a strong programme of product innovation and improvements to perceptions of quality, value and style. There remains a long way to go in our reshaping programme and clear opportunities exist for profitable growth to achieve the objective of a one percent increase in Food and Clothing & Home market share by FY28. Oracle today announced significant enhancements to Oracle Health Data Intelligence.

With the bursting of the bubble, the quality of financial reporting is again under scrutiny, but now for not adhering to traditional principles of sound earnings measurement, asset and liability recognition. This paper is a retrospective on the quality of financial reporting during the 1990s. My premise is that financial reporting should serve as an anchor during bubbles, to check speculative beliefs. With a focus on the shareholder as customer, the paper asks whether shareholders were well served or whether financial reporting helped to pyramid earnings and stock prices.